Maduro’s Capture Shifts the Balance Around Venezuelan Oil

The fate of billions of barrels of Venezuelan oil to which foreign companies are entitled under existing agreements has become far more uncertain following Washington’s recent intervention and the capture of President Nicolás Maduro. Analysts say the political turning point has cast doubt on the entire framework of arrangements between Caracas and its key external partners.

According to Bloomberg’s assessment, foreign state-owned companies — above all from China and Russia — now appear to be among the most exposed if Venezuela’s oil agreements are revised or rewritten.

China and Russia Hold the Largest External Claims

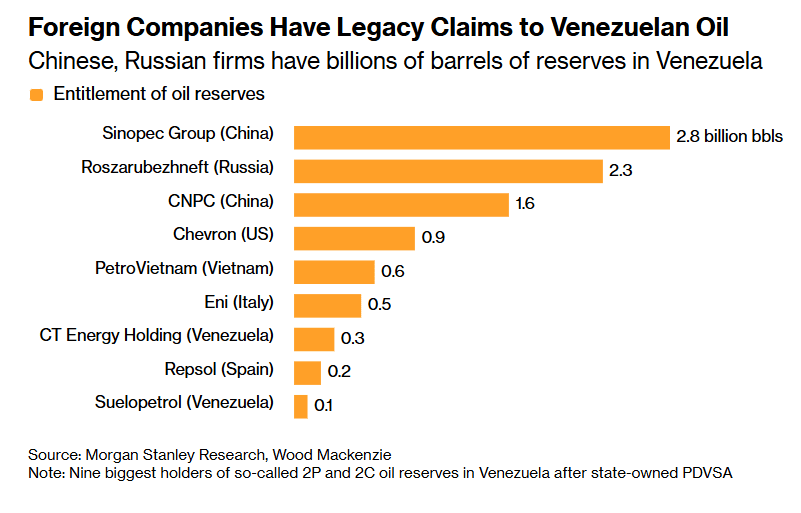

An analytical note by Morgan Stanley indicates that the largest foreign claims on Venezuelan oil are concentrated among Chinese and Russian state-controlled firms. At the same time, these assets pale in comparison with the scale of reserves controlled by the national oil company, Petróleos de Venezuela S.A. (PDVSA), which holds more than 200 billion barrels of oil.

Morgan Stanley analysts stress that the central issue is no longer merely legal entitlements, but the future trajectory of oil production itself.

“The crucial question is what will happen to Venezuela’s oil production from here. This remains extremely difficult to forecast,” the analysts said.

Over the medium term, however, they argue that risks to production are tilted to the upside, at least from a resource and technical standpoint.

Who Is Entitled to Venezuelan Barrels

Based on data from consultancy Wood Mackenzie, China Petroleum & Chemical Corp., known as Sinopec, has the largest entitlement, amounting to roughly 2.8 billion barrels of oil. It is followed by Russia’s Roszarubezhneft and China National Petroleum Corp. Roszarubezhneft acquired these Venezuelan assets in 2020 after purchasing them from Rosneft.

Smaller, though still notable, oil entitlements belong to Indian companies ONGC Videsh Ltd. and Indian Oil Corp., according to information published on their official websites.

Smaller Chinese Players and Production-Sharing Deals

In addition to major state-owned corporations, several lesser-known Chinese firms have entered into production-sharing agreements with PDVSA. These include Anhui Guangda Mining Investment Co., Anhui Erhuan Petroleum Group, and China Concord Resources Corp. This has previously been highlighted by Michal Meidan, head of China energy research at the Oxford Institute for Energy Studies.

She argues that Beijing and Chinese companies are likely to adopt a wait-and-see approach.

“The Chinese government and firms will probably watch how events unfold. They may lose flows and assets in the short term, but over time they could well find their way back to Venezuela,” she said.

Uncertainty Dominates the Outlook

In sum, despite the vast volumes of oil formally allocated to foreign companies, politics has once again become the decisive factor. As Bloomberg notes, the combination of geopolitics, sanctions pressure, and domestic instability makes the future of Venezuela’s oil sector — and foreign claims on it — deeply uncertain.

This article was prepared based on materials published by Bloomberg. The author does not claim authorship of the original text but presents their interpretation of the content for informational purposes.

The original article can be found at the following link: Bloomberg.

All rights to the original text belong to Bloomberg.