Telegram channel “USA:podstrochnik” specifically for Briefly

On February 20, 2026, in Learning Resources, Inc. v. Trump, 607 U.S. ___ (2026) (Nos. 24-1287 and 25-250), the U.S. Supreme Court held that the president does not have the authority to impose tariffs by invoking the International Emergency Economic Powers Act (IEEPA) of 1977, because that statute does not contain an explicit delegation of authority to the U.S. president to set customs duties and taxes.

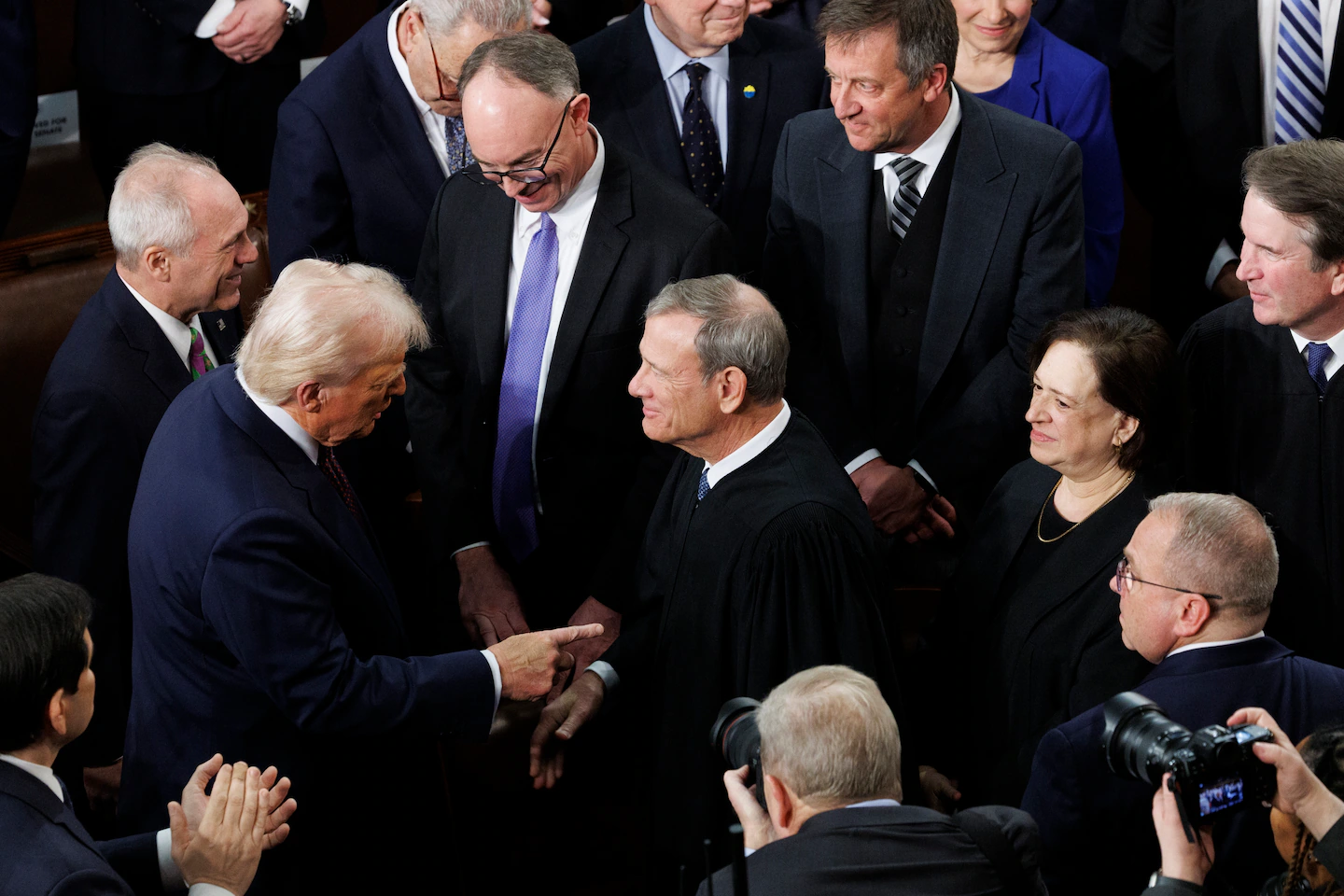

Chief Justice John Roberts wrote the majority opinion. The Court noted that the IEEPA allows the president to “investigate, block…, regulate, direct and compel, nullify, void, prevent or prohibit… importation or exportation,” but that “in this extensive list of powers there is no mention whatsoever of tariffs or duties.” The Court emphasized that if Congress had intended to grant the president “special and exclusive authority to impose tariffs,” it would have done so expressly—“as it invariably does in other customs statutes as well” (quotations via supreme.justia.com).

The controversial International Emergency Economic Powers Act (IEEPA) was enacted by Congress in 1977 (50 U.S.C. §§ 1701–1708) as a tool for the U.S. president in case of “unusual and extraordinary threats” to U.S. national security, foreign policy, or the economy originating abroad. The law allows the president to block assets, freeze accounts, restrict financial transactions, prohibit or regulate imports and exports, and impose sanctions measures on foreign states, companies, or individuals. The IEEPA became the principal legal basis for U.S. sanctions regimes—against Iran, Russia, Venezuela, North Korea, and other countries. However, the text of the statute contains no direct reference to tariffs or customs duties, which became the central issue in Learning Resources v. Trump.

The key disputed question in the case was the interpretation of the term “regulate.” The Trump administration tried to defend the position that the authority to “regulate … importation” includes the ability to impose tariffs. The Court rejected that construction. Chief Justice Roberts cited Black’s Law Dictionary and case law, noting that “regulate” means “fix, establish, or control,” but does not imply taxation. The Court specifically noted that in U.S. law the power to “regulate” is almost nowhere interpreted as the power “to tax” (to impose taxes). The decision gives an example: even the Securities and Exchange Commission (SEC), which is expressly authorized to “regulate securities trading” (15 U.S.C. §78i(h)(1)), is not entitled to impose a tax on transactions. By a majority vote, the Supreme Court rejected the Trump government’s position, stating that it is skeptical that in the IEEPA—and only in the IEEPA—Congress “hid” the power to impose taxes. In other words, the Court proceeds from the presumption that such a significant budgetary and trade decision requires an explicit and unambiguous statement in the text of the law.

However, U.S. President Donald Trump, criticizing the Supreme Court’s ruling, said that his authority to impose tariffs rests on other statutes as well—specifically, other provisions of U.S. trade law, including Section 232 of the Trade Expansion Act of 1962 (national security) and Section 301 of the Trade Act of 1974 (unfair trade practices).

“I’m ashamed of some members of the Court, absolutely ashamed that they don’t have the courage to do what’s right for our country… They are very unpatriotic and disloyal to our Constitution. I think the Court is under the influence of foreign interests and a political movement that is much smaller than one might imagine… It’s ridiculous, but it’s fine, because we have other ways, many other ways,” Trump said at a White House press conference after the decision, later announcing a new temporary 10 percent tariff.

Thus, the Supreme Court’s ruling is most likely not the end of the story, but the beginning of a long battle over the limits of presidential power in the economy. The point is that yesterday’s Supreme Court decision establishes only that Trump cannot use the IEEPA of 1977 as the legal basis for his actions. But until the Supreme Court issues another ruling, the U.S. president may rely on ambiguous provisions of other laws. Trump has already expressed his intention to do just that. This means that his opponents will have to challenge each individual statute the U.S. administration cites.

Still, for the American president’s opponents, the situation is not entirely hopeless. The Supreme Court decision contains an important constitutional precedent: the Court concluded that Congress’s power to impose tariffs and taxes can be transferred to the president through a specific statute only if there is an “explicit and unambiguous” indication of that in the text of the law.

The Supreme Court’s decision rests on a constitutional principle reflected in Article I, Section 8 of the U.S. Constitution, which assigns to Congress the powers to “lay and collect Taxes, Duties, Imposts and Excises” and to regulate foreign commerce.

At the same time, the Supreme Court does not dispute that Congress can delegate some of its powers to the president, but it requires a clear statement to that effect in the statutory text. In essence, the Supreme Court applies logic close to the Major Questions Doctrine: on issues of “major economic and political significance,” the executive branch must rely on clear congressional authorization. In this case, the Court found no such authorization.

Notably, the current Supreme Court is predominantly conservative. Three of the seven justices—Gorsuch, Barrett, and Kavanaugh—were nominated by Trump during his previous presidential term, and two of the justices he nominated supported yesterday’s Supreme Court ruling.

Historically, the Supreme Court has many times blocked actions by presidents, both Democrats and Republicans, when it found an overreach of authority. In West Virginia v. EPA (2022), the Court applied the Major Questions Doctrine to limit the Environmental Protection Agency’s authority in regulating the energy sector. In Biden v. Nebraska (2023), the Court struck down a student-debt forgiveness program, finding that the scale of the measure required explicit congressional authorization. Earlier, in NFIB v. OSHA (2022), a federal vaccine mandate for large employers was blocked.

In all of these cases, the Court demanded a clear and unambiguous legislative basis for measures with significant economic effect.

In 2023, in Biden v. Nebraska, 600 U.S. ___ (2023), the Supreme Court struck down a program of mass student-debt cancellation, citing the absence of a clear and unambiguous delegation of authority under the HEROES Act. The majority again applied the Major Questions Doctrine.

Similar limits were previously applied to Republican presidents as well. In Youngstown Sheet & Tube Co. v. Sawyer, 343 U.S. 579 (1952), the Court found unlawful President Harry Truman’s decision to nationalize steel mills during the Korean War, holding that the president cannot substitute himself for Congress.

Thus, the U.S. Supreme Court’s tariff ruling confirms the judiciary’s longstanding position: the president may act within delegated powers, but cannot “expand” the text of a law through interpretation.